- Home (kul2ww)

- ABOUT US

- SERVICES

- Global Wise Organized Service Items and Packages

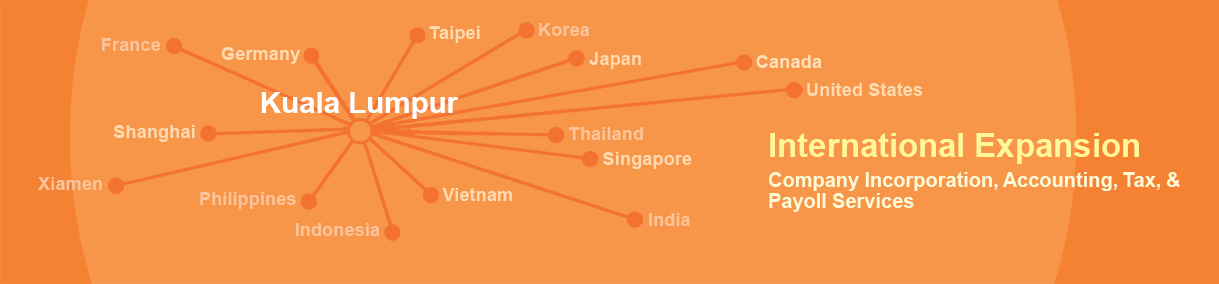

- Kuala Lumpur to APAC Main Cities Services Coverage

- Kuala Lumpur to China Due Diligence for M&A Project

- Kuala Lumpur to China Intelligent Property Service

- Kuala Lumpur to China Trademark Registration Services

- Assisting USA GAAP Compilation in Asia

- Technology

- Global Wise Organized Service items and Packages

- Country-by-Country Online Knowledge Database

- Cloud System support us to be a featured service provider

- Kul-to-APAC

- Tokyo Setup Accounting Tax Payroll One-stop Services kul2jp

- South Korean Setup Accounting Tax Payroll One-stop Services kul2kr

- Vietnam Setup Accounting Tax Payroll One-stop Services kul2vn

- Malaysian Setup Accounting Tax Payroll One-stop Services kul2my

- Thailand Setup Accounting Tax Payroll One-stop Services kul2th

- Philippines Company Registration Accounting Tax Payroll Services kul2ph

- India Setup Accounting Tax Payroll One-stop Services kul2in

- Indonesian Setup Accounting Tax Payroll One-stop Services kul2id

- Australia Setup Accounting Tax Payroll One-stop Services kul2au

- Singapore Setup Accounting Tax Payroll one-stop Services kul2sg

- New York Company Registration Accounting Tax Payroll kul2us.east

- Kul-to-CHINA

- China Capital Gain Tax when changing WFOE’s owners

- China WFOE De-registration and Liquidation Procedures

- China Major Cities Setup Accounting Tax Payroll One-stop Services kul2cn

- Beijing Setup Accounting Tax Payroll One-stop Services kul2cn.north

- Shanghai Setup Accounting Tax Payroll One-stop Services kul2cn.east

- Xiamen Setup Accounting Tax Payroll One-stop Services kul2cn.south

- Xiamen Temporary Employment Outsourcing kul2cn.south

- Xiamen Company Registration Services kul2cn.south

- Xiamen Company Registration – FAQs kul2cn.south

- Xiamen WFOE Accountant kul2cn.south

- Xiamen Payroll Compliance kul2cn.south

- Xiamen Trademark Registration Services kul2cn.south

- Fukien Setup Accounting Payroll Tax One-stop Services kul2cn.south

- Fuzhou Setup Accounting Payroll Tax One-stop Services kul2cn.south

- Quanzhou Setup Accounting Payroll Tax One-stop Services kul2cn.south

- Putian Setup Accounting Payroll Tax One-stop Services kul2cn.south

- Pingtan Setup Accounting Payroll Tax One-stop Services kul2cn.south

- Zhangzhou Setup Accounting Payroll Tax One-stop Services kul2cn.south

- Shenzhen Company Registration Accounting Tax Payroll One-stop Services

- Kul-to-Taiwan

- PEO-Services

- Taiwan Representative Office Setup kul2tw.ro

- Shanghai Temporary Employment Outsourcing kul2cn.east

- Xiamen Temporary Employment Outsourcing kul2cn.south

- Japan Temporary Employment Outsourcing kul2jp

- Korean Temporary Employment Outsourcing kul2kr

- Vietnam Temporary Employment Outsourcing kul2vn

- Philippine Temporary Employment Outsourcing kul2ph

- Thailand Temporary Employment Outsourcing kul2th

- India Employment outsourcing Services kul2in

- Indonesia Temporary Employment Outsourcing kul2id

- Australia Temporary Employment Outsourcing kul2au

- Germany Temporary Employment Outsourcing kul2de

- New York Temporary Employment Outsourcing kul2us.east

- Contact Us

- Sitemap(kul2ww)